Orange County Housing Report: The Luxury End is Back, But Tread Carefully!

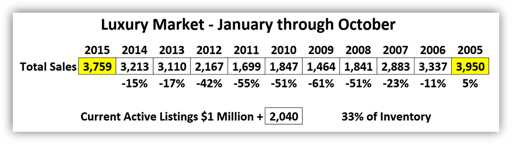

2015 marks the year that the high end fully recovered posting

the highest

number of $1 million plus home sales since 2005.

The Luxury Market: one-third of all homes that are listed “for

sale” are over $1 million.

Today, there are only 205 total foreclosures and short sales on

the active listing market in Orange County. In contrast, there are 2,040 homes

priced at $1 million and up. In October, there were 348 sales at $1 million and

up; yet, there were only 86 closed distressed sales. The distressed market is

down to 2007 numbers, edging closer to pre-recession days. It’s almost no

longer worth mentioning. On the other hand, the luxury market is back with a

vengeance, posting numbers in 2015 that have not been seen since 2005, one of

the hottest years in Orange County real estate.

For the luxury homeowner, this is great news. But, don’t

misread this. Just because the luxury housing market’s numbers are back, it is

not a pass to place a home “for sale” and have instantaneous success. Instead,

it’s a tough market with tremendous competition among other luxury sellers. The

number of buyers that can afford to purchase in the higher ranges is much more

limited, so it takes a bit longer for realistic sellers to find success.

Luxury homeowners are much more apt to overprice their

homes. Yes, overpricing is rampant in every range, but it is at an epidemic

level in the upper ranges. In taking a closer look at the 348 closed sales at

$1 million and up, 83% had to reduce the asking price at least once in order to find

success.

The biggest issue in the luxury market is that many

homeowners place their homes on the market with expectations based upon articles

written about the feverish pitch of the Orange County housing market for the

past few years. They hear about multiple offers and closed sales higher than

their asking prices. Homes are seemingly selling about as fast as they come on.

But, you have to be careful in what you read. There are price ranges that are

extremely hot, but they are primarily referring to homes priced between

$250,000 and $750,000. That range accounted for 72% of all closed sales in

October. The luxury price range only accounted for 14% of all closed sales.

Luxury sellers quickly find out the hard way that their

market is vastly different than the Orange County housing market that they read

about. Homes don’t necessarily fly off the market. There are fewer showings,

fewer offers, and the expected market time (the amount of time it takes to

place a home into escrow) is a lot longer for homes listed above $1 million. As the prices get more expensive, the market

time becomes longer and longer. The expected market time for homes priced

between $1 million and $1.5 million is currently at 130 days. It grows to 340

days for homes priced above $4 million. While luxury homes account for 33% of

all active listings, they only account for 15% of demand. Contrast that to

homes priced below $750,000 with an expected market time of less than 60 days,

they represent 50% of the active inventory and 71% of demand.

So, the numbers don’t totally stack up for luxury

homeowners. Many sit on the market for months, or even years, without success.

They simply fail to get in line with their true market value. Even though homes

in these price ranges don’t generate offers quickly, after a few months these

sellers can get a pretty decent snapshot of how the housing market is

responding to their home. Success can only be found in adapting to those

responses. The luxury seller’s common knee jerk reaction to stagnating for a

long time without success is “we don’t really need to sell.” That lack of

motivation translates to a waste of everybody’s time as these sellers

stubbornly refuse to listen to the market’s feedback to reduce the asking

price.

Once a home is priced according to their true market

value, it still does not guarantee immediate success. Luxury sellers have to

pack their patience as well. There are times where there just are not enough

luxury buyers looking to make a purchase. Like the fisherman looking to reel in

a big fish, having the right bait on the line does not guarantee that he will

soon be hauling a big catch into the boat. It takes time. It takes tremendous

patience.

Active Inventory: the

inventory dropped by 6% in the past couple of weeks.

In the past couple of weeks, the active inventory had its

largest drop of the year, shedding 377 homes. This time of the year is marked

with fewer new sellers coming on the market, an increase in demand, and many

unsuccessful sellers throwing in the proverbial towel in anticipation of the

much slower holiday season.

Last year at this time the inventory totaled 6,856 homes, 724

more than today, with an expected market time of 3.04 months, or 91 days, a

balanced market that does not favor a buyer or seller. In comparison, today’s

expected market time is 76 days, a slight seller’s market. A slight seller’s

market means that there is not much price appreciation, but sellers get the

opportunity to call more of the shots.

Demand: Demand increased by 3% in the

past couple of weeks.

Demand, the number of new pending sales over the prior

month, increased by 73 homes in the past two weeks and now totals 2,406 homes.

The increase is typical for this time of year, given that many new pending

sales are looking to close at the end of December, during the holidays. Buyers

are taking advantage of a decent time to move a family, while the kids are on

break.

From here, we can expect demand to remain the same over

the next couple of weeks before it really starts trending down during the

holidays. It will drop to its lowest level on New Year’s day before it begins

its annual rise.

Last year at this time there were 154 fewer pending sales,

7% less, totaling 2,252.